The European Company Statute:

Freedom of movement of the Societas Europaea

May 2001 Dr Maria Chetcuti Cauchi. All Rights Reserved.

In this article, the author seeks to analyse the basic differences in the two criteria used to determine a companys nationality. Also the general principle of freedom of establishment of companies envisaged by the Treaty of Rome is presented and the case-law dealing with freedom to change ones primary establishment is discussed. More specifically, the Societas Europaea (European Company) is tackled as a solution to the problem of the relocation of a companys primary establishment.

Table of Contents

Conflict of laws problems between different States

By setting up as a European Company a business can restructure fast and easily, to take the best possible advantage of the trading opportunities offered by the Internal Market. European Companies with commercial interests in more than one MS will be able to move across borders easily, as the need arises, in response to the changing needs of their business.

The original promoters of the ECS envisaged a corporate vehicle which would:

guarantee the Freedom of Establishment laid down in the Treaty, eliminate the possibility of conflict of company rules between two MSs of the Community and is ideal for a proper working of the European Capital Market.

As yet, complete freedom of establishment of companies has not been achieved by the European Community and it is hoped that the ECS will remedy the situation. Freedom of establishment is vital in the elimination of barriers that national frontiers set to the entrepreneurial and organisational skills of the nationals and companies of each MS. In a broader context, a more effective utilisation of available resources in the enlarged market is the paramount concern.

Change of the primary establishment of a natural person is possible within the EU and this is regulated by the Treaty of Rome. On the contrary, it is still national legislation that determines whether a legal person may change its registered office from one MS to another. It is amazing that at the present stage of European company law harmonisation, we still find a basic division within the EC on the manner in which a companys nationality and its connection are established. Two conflicting criteria are used to determine nationality and each of them points to the companys valid law, i.e., the basic legislation governing the companys affairs.

On the whole, the division lies between those jurisdictions which embrace the incorporation theory and those which opt for the sige rel (real seat) or the head office theory. The tension amongst these two different legal theories has been prevailing for long. The result is that the connecting factor used to determine which system of law is to govern the activities (especially the internal affairs) of the company differs from one MS to another.

1. Incorporation theory

Some countries within the EU, such as the UK and Denmark, espouse what has been described as the incorporation doctrine. This theory affirms that the law governing the activities of a company is the law of the State in which the company has been incorporated and the latter is the best system to determine matters such as validity of formation of the company and recognition of foreign companies. Thus, if the company conforms to the requisites under the law of the State of incorporation, it will be attributed with a legal personality, with all the rights and liabilities of a corporate existence, including limited liability.

2. Sige rel

Other countries make use of a different criterion to establish which law is to govern the company. The real seat theory (sige rel) takes the line that the law most suitable to govern the affairs of the company is the law of the place in which the company has its head office or central management and control.

In order the clarify the manner in which these theories work, it would be appropriate to explain by means of practical examples. The following are situations in which the above theories are applied and the manner in which the validity of formation of a company is determined by different MSs which adopt different theories.

Let us assume that there is a State called Nomos and a State called Emporio. Now, company ABC Limited was properly incorporated under the laws of Nomos but it has its head office in the State of Emporio.

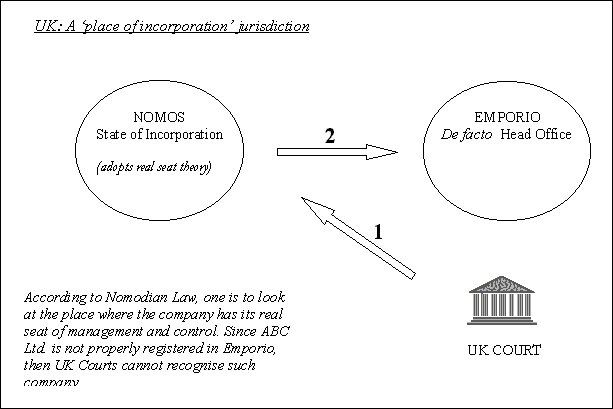

Case Study 1: UK Place of incorporation theory

A UK Court would base its decision on the validity of formation of ABC Ltd., by looking at the matter from the perspective of a Nomodian Court. Thus, if the law of Nomos recognizes ABC Ltd as a valid legal entity, then UK Courts would deem it to be such, whilst if on the contrary Nomodian law deems the company to be invalidly incorporated, then UK Courts would not recognize ABC Ltd.

If Nomodian law embraces the place of incorporation theory, and Nomos, as its place of registration, deems the company to be validly constituted under its laws, then the company would be deemed to be validly constituted in the eyes of an English Court.

Figure 2.1

If Nomodian law embraces the real seat theory, one should look at the law in which the company has its de facto headquarters. Now, when looking at the law of Emporio (place of de facto head office), Nomos will conclude that the company is not validly incorporated under the laws of Emporio, then an English Court which is looking through the eyes of an Nomodian Court, can only reach the conclusion reached by the Nomodian Court.

Figure 2.2

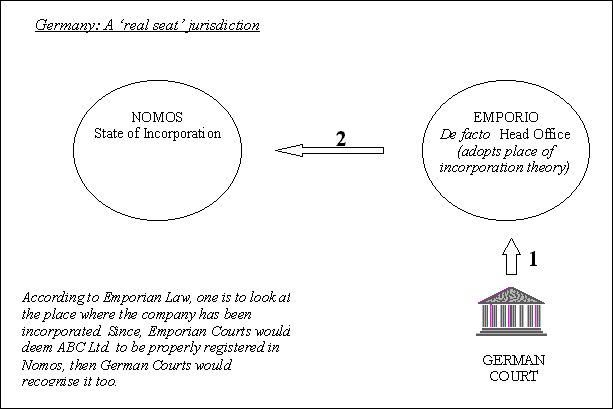

Case Study 2: Germany Real Seat theory

On the other hand, a German Court would approach the matter in a different manner. It would base its decision by looking at the law of Emporio as the law of the real seat of ABC Ltd., and ask whether the company is deemed to be validly constituted under the laws of Emporio.

If Emporian law embraces the place of incorporation theory, Emporian Courts would look at the law of Nomos (place of incorporation) and conclude that the company is validly incorporated under Nomodian law. Then, in turn, German Courts would recognise ABC Ltd.

Figure 2.3

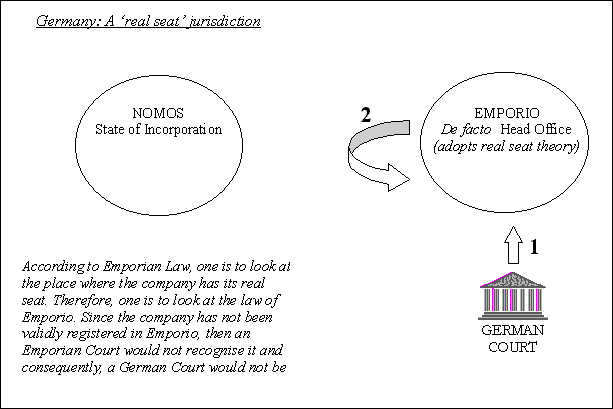

If Emporian law embraces the real seat theory, then Emporio would look at its own laws of incorporation and conclude that the company is not validly registered. Thus, German Courts would not be able to recognise ABC Ltd. In two similar German judgements, the German Court did not recognise the companies as validly incorporated and treated them as private companies in the process of incorporation.

Figure 2.4

Freedom of Establishment within the European Union

1. The Treaty of Rome

The Treaty of Rome addresses the question of freedom of establishment under Article 43.

Article 43: Within the framework of the provisions set out below, restrictions on the freedom of establishment of nationals of a MS in the territory of another MS shall be prohibited. Such prohibition shall also apply to restrictions on the setting up of agencies, branches or subsidiaries by nationals of any MS established in the territory of any MS.

Freedom of establishment shall include the right to take up and pursue activities as self employed persons and to set up and manage undertakings, in particular companies or firms within the meaning of the second paragraph of Article 48, under the conditions laid down for its own nationals by the law of the country where such establishment is effected, subject to the provisions of the Chapter relating to capital.

The first part of Article 43 provides for the establishment of a company through a branch or subsidiary. This is referred to as secondary establishment, as the legal person establishing such branch remains where it is. The second part of the Article presents the right of an individual to set up and manage an undertaking in any MS, as long as such individual abides by the conditions laid down for nationals in the country of establishment. This freedom is given full effect when MSs recognise the existence and validity of foreign companies carrying out business on their territory. Freedom of establishment seems to presuppose mutual recognition of companies and the two principles go hand in hand.

2. Specific negotiations to resolve this problem of conflict of laws

Article 293 of the Treaty of Rome provides that MSs shall enter into negotiations with each other with a view to securing for the benefit of their nationals, inter alia, the mutual recognition of companies or firms, the retention of legal personality in the event of transfer of their seat from one country to another (change in a companys primary establishment) and the possibility of mergers between companies or firms governed by the laws of different countries.

It is quite paradoxical that several EU countries have resolved the division between the main seat and the registration criteria, by entering into Treaties with third countries while they did not resolve the matter internally, within the EU. In fact, this question of recognition of a legal person from one State to the next has been left quite unresolved, except for the European Company Statute and the Fourteenth Directive.

3. Cross-border transfers of the registered office: Daily Mail case

The issue under discussion in the context of the ECS is the primary establishment of a company. It is a fact that by means of Article 43, the Treaty of Rome gives companies the right to establish a branch or a subsidiary in another MS, but can a company transfer its domicile, its primary establishment, from one MS to another?

Article 293 of the Treaty of Rome gives companies the possibility of entering into conventions among themselves on, a list of possible questions, including, retention of legal personality in the event of transfer of their seat from one country to another. However, in the absence of such agreement between MSs, can a company, similar to natural persons, uproot and move to another EU State? Transfer of the registered office has always been considered desirable, yet it also implies a large number of difficulties. This is because after a relocation, the original national law regulating the company ceases to apply, thus leading to the disappearance of the companys legal personality.

The Daily Mail case discloses a great deal about the complications caused by an operation of this kind. The company concerned decided to change its registered office from Britain to Holland. Thus, the transfer was between two countries which uphold the incorporation/registration theory. The company admitted that it had decided to carry out such transfer purely because it was moved by tax considerations as a substantial amount of capital gains tax had accumulated on the companys fixed assets. Under section 482 (1) (a) of the Taxes Act 1970, the Treasury had the power to give or withhold its consent to such transfer. The UK Treasury prevented the company from affecting a change in its registered office and refused to grant its authorisation.

The taxpayer claimed that the freedom to leave ones own State is a corollary of the right to establish oneself in another MS. By simply saying that a company could set up a branch in another MS, without giving that same company the full right of leaving its own country of domicile is tantamount to a restriction to the full freedom of establishment envisaged by Articles 43 or 48.

On the other hand, the British Revenue argued that Article 43 was intended to eliminate discrimination against nationals of another MS who wished to establish themselves in order to perform economic activities in their chosen country but it does not give a right to companies to establish central management and residence abroad.

The matter was referred to the ECJ under section 234 of the Treaty of Rome and the ECJ was requested to decide whether the authorisation needed under section 482 (1) (a) of the Taxes Act 1970 constituted a barrier to the movement of businesses. On revealing his own point of view on the matter, the judge referring the case claimed that:

My own inclination has been to doubt whether section 482 should be allowed to prevent or to fetter the voluntary movement of residence of a corporation which wishes to take advantage of a better fiscal climate in another MS within the EEC the object of the Treaty being the removal of barriers and the creation of an Economic Community without protective barriers of any kind either for persons or for corporations or for trade generally. The creation in other words of a true Common Market.

The question of change of a companys primary establishment, cannot be answered unambiguously and this is further reflected in the ambiguous conclusion reached by the ECJ. The pro-integration European Court, whilst laying out the principle that firms could transfer their registered office, still had to conclude that the Treaty, per se, does not give companies the right to a change their primary establishment. It also stated that the authorisation needed under the Taxes Act was compatible with Article 43 of the Treaty of Rome as the relevant provision of Community law did not resolve the matter. The Court added that since both Britain and Holland are registration States, i.e. States which uphold the place of incorporation theory, then a company exists only in consequence of the legislation of the State of incorporation. Since no Convention, under Article 293 had been concluded between Britain and Holland, then no right can be derived from Articles 43 or 48 to move the legal persons genuine domicile to another State. The only solution which could be given to the Daily Mail was that British law did not impede a dissolution of the company, payment of the tax and re-establishment in another EU State.

The SE: A Solution to Lack of Freedom of Movement of Companies

Article 8 of the proposed Regulation for a European Company provides that:

Article 8: The registered office of an SE may be transferred to another Member State in accordance with paragraphs 2 to 13. Such a transfer shall not result in the winding up of the SE or in the creation of a new legal person.

The introduction of the SE will result in the creation of a flexible scope within which companies would be able to transfer their registered office from one MS to another without having to undergo liquidation.

It is important to note that the introduction of the proposed Regulation will not obstruct the right which MSs have to tax any profits linked with the place of business in the State of taxation, but no such taxation will be incurred if the company retains the original State of registration as a branch.

If one keeps in mind the fact that a company may now be transformed into an SE, then it follows that now any share capital may be transferred into another MS without having to undergo liquidation and winding up as private companies have the possibility of changing into public companies and thereafter they could be changed into SEs. Moreover, the obligation of having a subsidiary or a place of business in another MS will surely not be a burden. This paves the way into a new era in which all companies will be given the opportunity to change nationality within the geographic area of the EU.

1. Issues arising from a change in the registered office

Protection of creditors

Article 8 (7) Before the competent authority issues the certificate mentioned in paragraph 5, the SE shall satisfy it that, in respect of any liabilities arising prior to the publication of the transfer proposal, the interests of creditors and holders of other rights in respect of the SE (including those of public bodies) have been adequately protected in accordance with requirements laid down by the MS where the SE has its registered office prior to the transfer.

A Member State may extend the application of the first subparagraph to liabilities that arise (or may arise) prior to the transfer.

Rights attributed to creditors under company law vary from one jurisdiction to another. These rights range from forms of security and associated publicity/registration requisites to preferential rights and insolvency rules.

Article 8 (7) gives quite a free hand to MSs in creditor protection mechanisms. The first mode of protection could be classified as a solvency reference which is to accompany the transfer proposal. This is further enhanced by the right attributed to creditors to apply to the Court on the grounds that the transfer proposal does not offer them sufficient security. Additionally, Article 8 (16), provides that in case of claims arising before the transfer has taken place, the SE shall be considered as still having its registered office in the MS where it was registered prior to the transfer, even if the SE was sued after the transfer took place. The transfer of registered office of an SE is also barred by winding up, liquidation, insolvency or suspension of payments proceedings which have been brought against it.

As in the proposed Fourteenth Directive, the proposed Regulation does not define what adequate security means. This adequate security which is provided to creditors seems to give such creditors some sort of ranking over others, but what if the company, after moving to another MS, creates other new secure creditors? Will the new creditors destroy the rights of the previous ones? The proposed Regulation is silent on the matter.

Besides, there is nothing in the proposed Regulation which deals with the eventual insertion of a jurisdiction clause into such a security, nor a clause which impedes the company from entering into new securities in the new place of registration. Will such clause be valid? If such clause is considered to be valid, what law is to govern such validity?

Protection of shareholders

The ECS provides that MSs are free to adopt provisions to protect dissenting minority shareholders. It seems that shareholders are given the right to request the Court that they are bought out at a fair price, however, it is held that one cannot really envisage a case where shareholders are given the power to block the transfer of the SE from one MS to another.

Upon drawing up a transfer proposal, the management/administrative organ of the SE shall include, inter alia, the rights which are provided for protection of both shareholders and creditors. Besides, the management/administrative organ is also obliged to draw up a report, whereby the implications of the transfer for shareholders, creditors and employees are delineated.

The proposed Regulation does not provide for either creditors or employees to have a say in the actual decision to transfer. Article 8 (5) permits MSs to adopt measures to safeguard the rights of minority shareholders, but other classes of shareholders or other interested groups are not mentioned.

Protection of Employees

Apart from the case where workers have a right to vote at the general meeting ( e.g. the workers are also shareholders), the Statute offers no rights to employees, in the case where an SE changes jurisdictions. Article 8 (4) does not even mention employees when it refers to the right which shareholders and creditors are given to examine the report issued by the management team. On the contrary, the proposed Fourteenth Directive does deal with the matter, even though in a limited manner. The latter provides that in the case where employees formed part of the management board of the company prior to the proposed transfer, then examination of the report issued by the management team will be possible.

One should also address the question of whether the participation rights which employees enjoyed prior to the transfer, would subsist. Are the participation rights which the workers enjoyed deemed to be company law rights which will change as soon as the law of the registration of the company is changed, or will such rights subsist even under the new law of registration? One could argue that, since existing employment contracts do not change with the transfer, then if such participation rights are embedded in this contract, they also would subsist. However, the proposed Regulation is silent on this matter too.

2. Change of effective headquarters: implications

Due to the linkage imposed by the proposed Regulation between movement of the registered office and the head office of the SE, it is argued that freedom of movement of the head office could also be inhibited. A change in the registered office of a company corresponds to a change in the law applicable to the company, thus movement of headquarters could result in being too costly and uncertain. On moving headquarters, the company will have to adjust its mode of action and the rules governing its manner of conducting business to comply with the laws presented by the new place of registration, thus resulting in pricey and doubtful arrangements.

The SE: a limited solution to freedom of establishment of companies?

Article 7: The registered office of an SE shall be located within the Community, in the same MS as its head office. A MS may in addition impose on SEs registered in its territory the obligation of locating their head office and their registered office in the same place.

The proposed Regulation provides that location of an SEs registered office must be in the same MS as its head office and it must be located within the Community, thus ensuring effective monitoring of an SE by that same MS. The latter may also impose, on SEs registered within its territory, the obligation of setting up their head office and their registered office in the same location.

Article 7 of the proposed Regulation seems to provide a compromise between the place of incorporation rule and the sige rel theory as it appears to provide a solution both for those States that advocate the State of incorporation theory and also for those that uphold the sige rel theory. The solution was to link both requisites together and provide that the registered office cannot be transferred unless there is also a transfer of the head office. However, this solution has somewhat limited the flexibility of the ECS.

The fact that the registered office and the sige rel must be in the same MS presents a variety of problems. First of all, it is potentially problematic to try to decipher where the head office is located. Many times such location is quite unclear as a variety of processes in the administration of the company may be taking place in a variety of locations. Article 7 was the one which Netherlands, a place of incorporation jurisdiction, refused to consent to in 1998 at the Internal Market Council meeting. In addition, Article 7 seems to be paradoxical when compared to the freedom of establishment opportunity presented by Article 8. On the one hand, the SE is a company which has the advantage of transferring its registered office without the need to go through the process of winding up and creating a new legal person and on the other hand, its registered office can only move to another MS if and when the head office is also moved to that same MS.

This criterion of changing the registered office and the head office simultaneously is in step with legislation governing public companies in a large number of MSs which uphold the sige rel theory. However, it is still at odds with the practice of other MSs, such as the UK, Denmark, Ireland and the Netherlands, as the latter acknowledge only the place of incorporation rule as the determining factor in establishing which law is to govern the company. The latter require nationally registered companies to have their registered office in the MS concerned but they are left free to choose the location for their head office. This is because the governing law of the company would still remain the law of the place of registration, irrespective of the location of the head office. Such requirement of having companies maintain their head office in the MS of registration could unduly restrict the flexibility of movement of the SE, thus leaving it quite incapable of responding to changing commercial needs.

The proposed Regulation, on the one hand, emphasises the freedom to transfer an SEs registered office throughout the EU while maintaining its legal personality, whilst on the other hand, the authorities of the MS in which the SE had its registered office could order the SE to be wound up or liquidated if its registered office and head office are located in different MSs. This paradoxical situation has been explained by some as a necessary evil, in that, it is the only system that allows effective supervision of the whole SE, so as to avoid the SE being used for suspicious practice such as tax fraud or money laundering.

The problem is that the corporate form could be manipulated and used for fraudulent or abusive purposes. Now, in various cases, a solution to this problem has been found by national courts where the latter have ignored the corporate form when they deemed it appropriate to do so and lifted the veil in order to reveal abusive practices. Thus, by analogy, the precedents, created in relation to the lifting of the veil of incorporation in other cases, could be resorted to in order to nullify the effects of the transfer of the SE, if such transfer is deemed to have been carried out for fraudulent purposes. Thus, provisions enabling an SE to transfer its registered office and seek registration in another MS, would co-exist with provisions which regulate and check abuse of this right of movement, thus ensuring that this right is not employed abusively.

Change of registered office: possible Delaware effect?

The presumably low level of protection afforded by the proposed Regulation to employees, shareholders and creditors, in case of transfer of registered office, may produce two different results. MSs may either decide to make use of all sorts of measures, such as tax incentives, to prevent companies from leaving their jurisdiction or else, companies will start to forum shop to find the least regulated environment. This has occurred in Delaware where corporate law in an industry. The characteristics of Delaware corporate law have been outlined by Professor Cary as including, inter alia , low standards, ease of access to courts; less restrictions upon selling assets, mortgaging, leasing and merging; permission to have staggered boards and public policy of raising revenue.

The registered office is the location which determines what national law is to be applied to the SE each time the proposed Regulation refers to national law. This could result in a situation where the SE transfers its seat from one MS to another on choosing jurisdictions with less stringent rules. Thus, if there is a MS with lenient rules on a particular aspect of the SE, a company would have much more interest in having that MSs law governing it, rather then the law of a MS which offers a more disadvantageous position. The same situation has occurred in the US where various American States were coerced into succumbing to the temptation of excessive liberality. Competitiveness was the primary factor which induced them in doing so.

The race was one not of diligence, but of laxity. Incorporation under such laws was possible; and the great industrial States yielded in order not to lose wholly the prospect of revenue and the control incident to domestic corporations.

This potential problem is further emphasised by the lack of harmonisation in the EU of particular company law areas, such as insolvency law and liquidation procedures. Thus, until such time that European minimum standards are agreed, MSs would only have one choice: either start running in the race or admit defeat and try to support the national economy in the loss it suffers due to emigrating business.

This concern of a possible European race to laxity has arisen after the delivery of a recent decision by the ECJ, the Centros decision. In this case, Centros Ltd. was registered in England and Wales (an incorporation jurisdiction) and its share capital was of 100, which was neither paid up nor made available to the company. In 1992, Mrs Bryde, one of the two shareholders, sought to exercise the right of establishment under Chapter 2 of the Treaty of Rome, by registering a branch of the company, in Denmark (also an incorporation jurisdiction).

However, Danish authorities refused to register such branch as they claimed that, in reality, the branch was going to be used as the main establishment. The Danish Department of Trade insisted that the tactic which the two shareholders of the company were using, was intended to circumvent the paying-up of the minimum capital required under Danish law, DKK 200, 000. The Court reached the conclusion that the company was properly incorporated according to the law of England, the law of incorporation but it did not analyse whether the company was properly incorporated under the law of Denmark, the law of its real headquarters. Had the Court applied the real seat theory, most probably it would not have recognised the company as the company did not satisfy the requirements of the systems of the law of the State in which its central management and control was situated. The case seems to bear witness to an implicit sanctioning of the incorporation principle. However, in view of the admittance by the Brydes that the tactic was used to circumvent the Danish minimum capital requirement, one starts to appreciate more the rationale behind the real seat theory.

The conclusion reached by the ECJ echoed the sentiments previously expressed in the Segers case of 1986. The court reached the conclusion that it was wholly:

Immaterial that the company was formed in the first Member State only for the purpose of establishing itself in the second, where its main, or indeed entire, business is to be conducted.

This liberal decision has been interpreted in many ways. Some have claimed that it is a cloaked disregard for the real seat theory and a marked preference of the incorporation theory. However, others have affirmed that it is just a clear indication of great emphasis which the ECJ is placing on freedom of establishment of companies, because even though the Court did not address the question of mutual recognition of companies directly, yet implicitly it still highlighted the fact that a more liberal approach is necessary and freedom of establishment should be given precedence over other principles.

The fact that companies operating in the European Market still have to shop around in pursuit of a more advantageous system demonstrates that the European harmonisation programme is yet not fully effective.

Progress on the harmonisation of company laws has to date been somewhat disappointing. The challenges of the Europeanisation of businesses and some of the challenges facing company law in general have been abandoned, or at least not pursued with any vigour. Instead the company law harmonisation has been dominated in its early years by addressing technical matters, and technical obstructions to the freedom of establishment.

The ECS would potentially diminish the possibility of companies drifting from one jurisdiction to another in search for the system which best suits their criteria as all SEs would be governed by a law which is, to a large extent universal. This coupled with a more harmonised Company law programme would surely minimise the risk of a possible Delaware effect.

May 2001 Dr Maria Chetcuti Cauchi. All Rights Reserved.